The decentralized finance (DeFi) movement is the new corner of crypto that has taken the industry by storm. DeFi has become the latest hotbed because its applications are permissionless and allow anyone with an internet connection to interact with them. Moreover, DeFi applications do not require trust in third-parties or custodians. Being trustless is one of the key principles upon which blockchain technology is built upon.

But much like the ICO boom of 2017 which later proved to be a bubble, questions naturally arise on whether DeFi is all hype and no value at all. What we know for sure is that the DeFi boom has attracted mixed reactions from industry experts. And while some experts warn that the DeFi movement will eventually follow a similar trajectory to the 2017 ICO craze, others are looking to capitalize on the current wave.

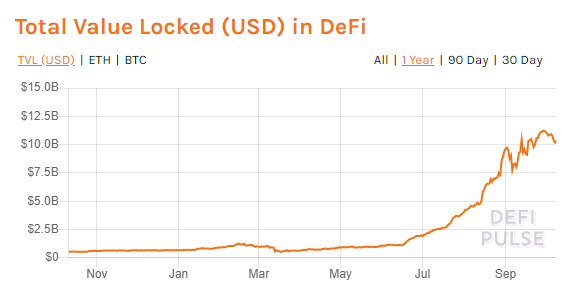

The best way to measure the growth or health of the sector is using what insiders call total value locked (TVL) in DeFi. This is simply a measure of how much the sector is worth. According to DeFi Pulse, a service that tracks the TVL in DeFi, the sector is — at the time of writing — worth $10.3 billion. To put things in perspective, the sector was worth $566,67 million a year ago. A growth of more than 1,700 percent.

The Total Value Locked (TVL) in DeFi has grown from $566.7 million to $10.3 billion in one year. //Source: DeFi Pulse

Underneath this DeFi movement is a hot jam called “yield farming.” In some circles, they refer to yield farming as liquidity mining.

What is yield farming?

To many people, the word farming invokes the thoughts of soil, dirt, crops, animals, and more. This couldn’t be far from the truth. In DeFi, yield farming is similar to real-world farming except that it is done digitally. And it is very complicated.

Yield farming is a new way in which cryptocurrency holders earn rewards by locking their digital assets in liquidity protocols. It allows you to earn passive income by putting your crypto to use. In a certain way, this will likely change how crypto investors HODL their money. It is an open secret that many people in crypto just buy their desired assets and hold on to them for a long time while waiting for their value to appreciate. With yield farming, you can wait for that to happen while earning money along the way. In a way, this is similar to depositing your money in a bank and earning interest over time. While we can draw this parallel, I have to highlight that yield farming is very complex as it is still new territory.

Yield farming relies on liquidity providers (LPs) who provide funds to liquidity pools. A liquid pool is a smart contract or platform that holds the funds. Liquidity providers get their reward for injecting liquidity into the liquidity pool. Technically speaking, yield farming is the act of earning rewards to provide liquidity to smart contracts that pose as liquidity pools. Yield farming is growing as new protocols promising better returns start to emerge. But how easy is it for ‘farmers’ to obtain a yield on their digital crops?

Tips for a profitable harvest

Here are some tips on how to increase your chances of yielding a more profitable harvest.

Invest in knowledge

You don’t wake up one morning and decide to be a farmer and start farming right away. You need to educate yourself about soil, fertilizers, animals, farming equipment, weather patterns, etc. The same goes for yield farming and the broader crypto industry. Yield farming strategies are novel, complex, constantly changing, and possibly very risky for newbies. Take your time to learn as much as you can. There is no shortcut to this.

Turn to the most profitable money markets

There are plenty of money markets in yield farming. Liquidity mining uses models similar to those employed by automated market makers (AMM).

As a liquidity provider, you deposit funds into the liquidity pool. This pool can be an exchange or a protocol for borrowing and lending. Using these platforms is not free. Users have to pay fees. These fees add up and are paid out to all liquidity providers depending on how much they contributed to the pool. The more you contribute, the higher are your chances of earning more. This method is good for farmers with a lot of money as their share of the liquidity pool is high. It is one of the main reasons why yield farming is more like the game for institutional investors or whales because ordinary retail investors may not have the financial muscles that could eventually lead to profitable harvests.

As there are several liquidity protocols you can turn to, do your due diligence and find those that give you higher returns. Do not only be blinded by the returns, but also consider the security of the platform. The crypto industry attracts hackers that could siphon all the money from your liquidity protocol.

Incentive scheme

Yield farmers have the option to earn their rewards in the form of a protocol’s native token. For example, liquidity providers on the Synthetix platform earn SNX tokens for their efforts. These native tokens can appreciate in value, providing higher returns to liquidity providers. CoinGecko data shows that the price of the SNX token increased from $0.49 in October 2019 to its current price of $3.99.

SNX token price increased from $0.49 to $3.99 in one year. // Source: CoinGecko

Use simple platforms

The majority of DeFi protocols have challenging user interfaces which require a higher level of technical knowledge for users. This can be challenging for intermediate users. The best they can do is turn to simple platforms such as Yearn.finance where they simply have to deposit their tokens and earn interest.

Look out for risks

The cryptocurrency as a whole is very risky. It is prone to speculation, hype, and bubbles. But beyond that, there are also dangers of hacks and exit scams. Yfdexf.finance pulled off an exit scam and disappeared with $20 million of investors’ money. The former DeFi project deleted its website, tweets, and Telegram accounts. Be careful of new platforms as they can be easily manipulated or hacked.

Other risks include earning your yield percentage in the form of reward tokens. These tokens are very volatile and their value could drop significantly, leaving you in the red.

What is the catch?

Those in the crypto industry long enough know that it is important to maximize your profits while the DeFi momentum still has a lot of traction. This momentum will decrease with time as the hype subsides and real value emerges. This current trend is a microcosm of the whole crypto sector and how speculation plays a huge role in building wealth for early players. The same thing happened during the 2017 ICO boom.

For now, use these tips to get a profitable harvest. Look out for the risks and keep your ear on the ground. You never know what’s coming next.